Connectivity Between Systems

The REAL Farm Credit Database connection allows you to connect data from a number of different sources such as your Accounting Software, Client Management Systems, In-house Databases, Excel Documents, and Websites. By using this comprehensive approach and connecting all of your systems together, your ability to manage your accounts will improve. You will be able easily meet your borrowers’ needs now and into the future.

Flexibility to Adjust Documents to Meet Your Needs

We provide greater document flexibility by using HotDocs. With HotDocs, you can adjust your documents and interviews to meet your exact needs. This allows you to maintain control of the content, format and style of your documents. Future modifications of your documents can be done by your trained staff or REAL

Expert Work Flows

By using HotDocs we help you create a dynamic interview that guides your loan officers and loan processors through the document creation. Depending on your office specification, during the interview process we can require information, add or remove questions based on previous answers, and produce multiple documents at the same time.

Create Word and PDF Documents

After borrower and loan information is entered, HotDocs can create either a Word or PDF document, which are familiar formates for your staff members.

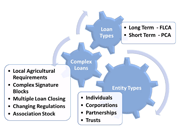

Flexibility to Handle Complex Loan Structures

Flexibility to Handle Complex Loan Structures

As we have worked with the Farm Credit industry we have found that the loans can be very complex. Because of this complexity and the competitiveness of the industry, Farm Credits need a document system that will accurately and quickly produce loan packages, letters, and other documents, all while keeping the information input as simple as possible. Some areas needing special attention are:

- Local Agricultural Requirement

- Complex Borrowing Groups

- Complex Signature Blocks

- Multiple Loan Closing

- Changing Regulations

- Association Stock

Single Entry of Data

We can create an environment where you can have a single point of entry and connect information throughout your organization. Client information that is in a spreadsheet, customer management system, or other sources, can now be used to begin creating documents for the loan. Creating a single entry point decreases errors and save a significant amount of time.

Report Creation

The ability to create reports from your borrower and loan data is an integral piece to what we provide during implementation. We work with our clients to ensure that once the system is implemented, our clients are able to access the data that they need to make critical decisions about their borrowers and the loans they are creating.

The ability to create reports to get the reports that you need from your data is an integral piece to what we provide during implementation. We work with our customers to ensure that once the system is implemented, our clients are able to access the data that they need to make critical decisions about their clients and the loans they are creating.

We invite you to learn more about how REAL Automation Solutions and HotDocs can help you automate your documents and streamline your client management. Please contact us at 801-766-3183 to set up an appointment.